Every year, a number of “quotes of the year” lists are published.

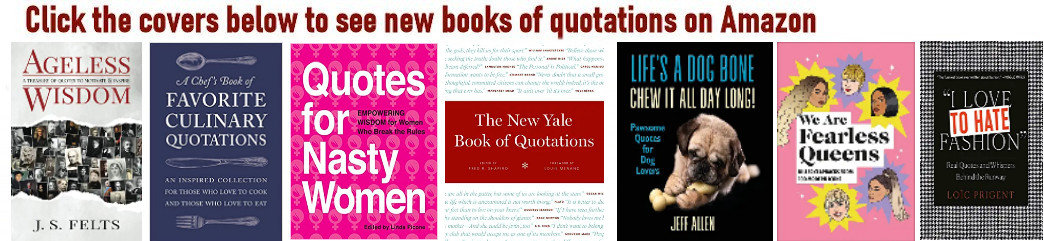

My favorite is the annual list issued by Fred R. Shapiro, editor of the excellent Yale Book of Quotations.

But my own picks for the top quotes of 2009 include some that are not on Fred’s list.

Two of them share an unusual characteristic. They were both made famous in 2009, but they are not new quotes.

In late May of 2009, President Barack Obama nominated Sonia Sotomayor, a judge of Hispanic descent, to serve on the United States Supreme Court.

Republicans and conservative talk show hosts raised various objections and issues, hoping to prevent her confirmation by the Senate. The thing they dug up that seemed to get the most media attention was a comment Sotomayor had made eight years previously.

In a speech at the Berkeley School of Law on October 26, 2001, Sotomayor noted that gender and cultural background affect any judge’s view. However, she added:

“I would hope that a wise Latina woman with the richness of her experiences would more often than not reach a better conclusion than a white male who hasn’t lived that life.”

Only a handful of people had ever heard of the quote until it was used in the debate over her nomination in 2009.

When conservatives claimed the quote showed Sotomayor was a reverse racist, it created a media firestorm.

Sotomayor was confirmed anyway. But the hubbub over her “wise Latina” remark made it one of the most notable quotations of 2009 — even though she’d said it years before.

The second notable quote that had a delayed rise to fame in 2009 is the phrase “too big to fail.”

It gained wide use during the past year to defend and deride the recent government bailouts of some of the country’s largest financial firms. But it was actually coined 25 years ago, during another government bailout.

In 1984, Continental Illinois — the seventh largest bank in the country at the time — faced insolvency due to overly aggressive lending policies.

The bank’s lobbyists and federal financial regulators warned that, if Continental were allowed to “fail,” it would threaten dozens of other banks and the entire economy.

Therefore, they argued, Continental should be bailed out with taxpayers’ money.

And, it was. Continental ultimately received $4.5 billion from the Federal Deposit Insurance Corporation (FDIC).

On September 19, 1984, during Congressional hearings on the bailout, Congressman Stewart B. McKinney (R-Conn) observed wryly:

“Let us not bandy words. We have a new kind of bank. It is called too big to fail. TBTF, and it is a wonderful bank.”

Continental Illinois survived thanks to the government’s largesse. In 1994, it was acquired by Bank of America.

McKinney’s “too big to fail” also survived. But, but until, recently it was an obscure phrase known primarily to financial insiders.

In the most recent bank crisis, financial institutions received $700 billion from the federal Troubled Asset Relief Program (TARP), because they were deemed “too big too fail.” One of them was Bank of America.

The TARP funds first began to be disbursed by the Bush administration late in 2008. This year, as the Obama administration continued and expanded the bailout, the widespread use of “too big to fail” made it (in my opinion) one of the top quotes of 2009.

.